Maintaining services and rates

What was the proposal for the community

Council proposed to maintain its current rate income beyond 2023-24 for a further 7 years to ensure financial and service sustainability. Securing the current rate income for a further 7 years would ensure that we are able to maintain the current service levels, continue to find more service efficiencies and pay back loans.

We explored this option with you through our community awareness and engagement program from October 2021 through to January 2022. This program allowed us to:

- Better understand the community view on what services are important

- Define community expectations around the service levels

- Respond to this in a future rate proposal

Consultation results

Throughout the community engagement and awareness program we explored a range of options pertaining to the importance of services and expected service levels with you.

A consultation report detailing what we heard is available here.

Will Council proceed with its application to IPART

Yes. At the meeting of Council on 3 February 2022, Council resolved to proceed with its application to IPART to secure the current rate income for a further 7 years.

Between 15 February and 7 March, IPART exhibited Council's application to maintain the current rates. You can find more information, including Council's IPART application at ipart.nsw.gov.au.

Was Council’s application to IPART successful?

Yes. Council rates will be maintained following the IPART determination.

The Independent Pricing and Regulatory Tribunal (IPART) has approved Central Coast Council’s 2022 Special Variation to maintain rates at their current levels for an additional seven years, equalling ten years in total to 2031.

IPART’s determination supporting the continuation of Central Coast Council’s current rate structure for a further seven years will allow Council to continue to maintain current service levels, comply with current banking requirements and most importantly, allows us to continue without interruption our 10-year long-term financial plan that provides long-term financial stability for the organisation.

It is important to note that there is no increase to your rates. This is a continuation of the current rates you pay with the exception of the rate peg as determined by IPART every year.

Central Coast Council will now examine services where we’re not delivering to community expectations and reflect this in future operational plans for an incoming Council to consider.

IPART’s determination to allow Council to maintain rates to June 2031

The Independent Pricing and Regulatory Tribunal (IPART) has approved Central Coast Council’s 2022 Special Variation submission to maintain rates at their current levels for an additional seven years, to June 2031, a total of ten years.

For more information and FAQs, go to ‘Financial Recovery Plan’ page on Council’s main website, centralcoast.nsw.gov.au.

Related projects

Document Library

Find out more

What has happened so far

In May 2021 the Independent Pricing and Regulatory Tribunal (IPART) approved a temporary rate increase of 13% (plus the 2% rate peg) which is retained in the rate base for three years and removed from the rate base at the end of the 2023-24 rating year for the Central Coast Local Government Area.

This temporary one-off increase will provide $22.9M in additional income for the 2021-22 financial year and is one of a number of measures being implemented to ensure Council remains financially sustainable.

In their final report issued in May 2021 IPART stated, “During this 3-year period, the council will be able to implement its proposed business recovery plan, consult with its ratepayers regarding appropriate service levels, and if required, apply for a permanent Special Variation.”

On 29 September 2021, Council resolved to notify the Independent Pricing and Regulatory Tribunal (IPART) of its intention to apply to maintain the temporary Special Variation (SV) implemented in the 2021/22 financial year beyond its expiry in June 2024 for a further seven years. Community feedback would be used to help inform whether or not Council decided to formally apply to IPART for a Special Variation in February 2022.

From October 2021 to January 2022 Council explored the option to maintain the temporary Special Variation (SV) for a further 7 years with the community through our community awareness and engagement program to better understand the importance of services offered and associated expectations on delivery.

The feedback received during the community awareness and engagement program supported Council formally submitting the application to IPART.

At the extraordinary meeting of Council on 3 February 2022, Council resolved to submit the application to extend the current temporary SV for a further 7 years.

On 10 May 2022, the IPART determination was handed down. IPART announced that Council was successful in its application to maintain rates at the current levels for an additional seven years. This decision will allow Council to continue to maintain current service levels, comply with current banking requirements and most importantly, allows us to continue without interruption our 10-year long-term financial plan that provides long-term financial stability for the organisation.

It is important to note that there is no increase to your rates. This is a continuation of the current rates you pay with the exception of the rate peg as determined by IPART every year.

How have we responded to community feedback

We have moved quickly to show that we are serious about helping to fix the problem. Here is what we have done so far.

- Better financial management and accountability

- Chief Financial Officer appointment

- Audit and Risk Committee meet every two months

- Monthly financial reporting publicly available

- Tighter budget management controls

- Reduced spending

- Capital works program reduction to $175M in 2020-21 compared to $242M in 2019-20

- Materials and contracts savings estimate of $20M

- Reduced employee costs by $30M

- Management salaries with reduction of nine Directors to five and senior managers from 38 to 25

- Other financial recovery actions

- Over $60M of property assets sold

- Improved productivity with minimum service level reduction despite staff cuts

- Bank loans secured and payments on track

- Finding other revenue sources.

Community Reference Group

A representative sample, of randomly selected ratepayers formed a Community Reference Group.

The purpose of the Community Reference Group was to provide guidance to Council about the key messages, the community engagement activities and to explore options in relation to Council service reductions should any application to maintain rates at their current levels not be successful. An independent third party was used to recruit the members for the Community Reference Group which commenced in late October 2021.

Central Coast Council is also seeking expressions of interest for membership to a Community Reference Group that will provide advice and guidance on the Revised Community Strategic Plan and Draft Delivery Program 2022-2025 (including the Operational Plan 2022-23).

IPART’s determination to allow Council to maintain rates to June 2031

How does this relate to last year’s determination by IPART for ordinary rates?

In May 2021, the Independent Pricing and Regulatory Tribunal (IPART) approved a special variation for a one-off temporary increase of 13% in 2021-22 to remain in the rates base for a period of three years (from July 2021 until June 2024). This is exclusive of the rate peg (the maximum percentage by which Council may increase its general income for the year) as determined by IPART annually. For the 2021-22 period, the rate peg was 2%.

The IPART determination handed down on 10 May 2022 allows Council to maintain rates at these levels past the 2023-24 rating year for a further 7 years to 2030-31 (ten years in total), with the annual increase capped at the rate peg which is determined by IPART each year. This means that the maximum increase in Council’s rating income is the annual rate peg from 2022-23 and onwards. For 2022-23 Council’s rating income will increase by 1% (0.7% base rate peg plus 0.3% population factor) as determined by IPART.

The reduction in rates will be in 2031-32 when the 13% temporary special variation is removed.

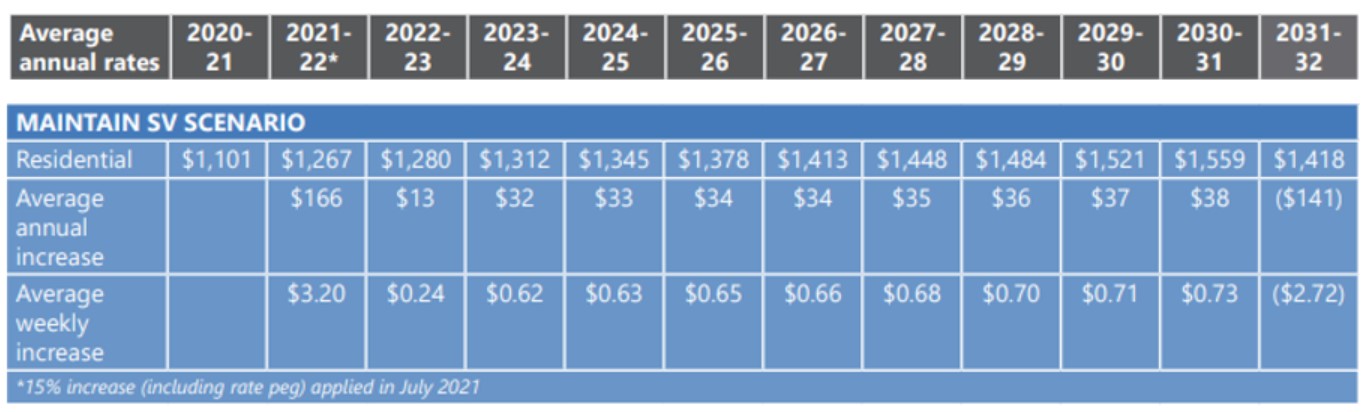

The table below shows the average annual rates for a Central Coast resident for the next 10 years assuming the annual rate peg is 2.5% from 2023-24 (in accordance with the IPART SV application assumptions).

How does this May 2022 determination impact my rates?

It is important to note this is a continuation of the rates you currently pay, with the annual increase capped at the rate peg which is determined by IPART each year.

IPART determines the maximum percentage which NSW Councils can increase their rates income each year, which is referred to as the rate peg. For 2022-23 IPART has determined a rate peg of 1% for Central Coast Council. This means the average annual rate increase for residents for 2022-23 is $13.

Who is IPART and what do they do?

The Independent Pricing and Regulatory Tribunal (IPART) is an independent NSW Government authority that helps NSW residents get safe and reliable services at a fair price. IPART is:

- The independent pricing regulator for water, energy, public transport and local government

- The licence administrator of water, electricity and gas

- The scheme administrator and regulator of the Energy Savings Scheme.

For Local Government IPART determines the annual rate peg and special variations. When a Council applies for a special variation (rates) determination, IPART assesses the application based on the following criteria:

- The need for, and purpose of, a different revenue path for the council’s General Fund (as requested through the special variation) is clearly articulated and identified in the Council’s IP&R document

- Evidence that the community is aware of the need for and extent of a rate rise

- The impact on affected ratepayers must be reasonable

- The relevant IP&R documents must be exhibited (where required), approved and adopted by the Council

- The IP&R documents or the Council’s application must explain and quantify the productivity improvements and cost containment strategies

- Any other matter that IPART considers relevant

For more information about IPART, go to www.ipart.nsw.gov.au.

Was an extended rate rise necessary?

Yes. Securing the current rate income for a further seven years has ensured that current service levels can be maintained, as we continue to find more service efficiencies and pay back emergency loans.

Council has met all milestones and targets in its Financial Recovery Plan that was put in place in late 2020 to address the financial situation of significant accumulation of debt, and to ensure long-term financial sustainability. If Council’s current rate income was not maintained beyond June 2024, we would have been forced to significantly reduce or cease many services to reduce expenditure by $25.8 million each year.

Why were there only two options considered: maintain rates or reduce or cease services?

Other measures were put in place and we are continuing to address the financial situation. We have done everything we can behind the scenes to reduce costs without largely impacting on the services we deliver for the community. These cost management measures made up 70% of what we needed to do to satisfy the external lenders that we were getting Council finances back on track. The other 30% came from the temporary 13% (plus 2% rate peg) rate increase approved by the Independent Pricing and Regulatory Tribunal (IPART) in May 2021.

In February 2022, Council resolved to proceed with its application to IPART to secure the rate income for a further seven years; in May 2022 IPART approved the application. This means that the current rates will be maintained for a period of 10 years with the annual increase capped at the rate peg which is determined by IPART every year.

If the current rates were not able to be maintained beyond June 2024, Council would have had an average annual income loss of $25.8 million. This would have resulted in the need to reduce or cease many services.

What are alternative income options to rates?

We are already working on sourcing more income for Council through the financial recovery action of selling underutilised property assets. Even if the community agreed to sell more properties such as community land, this is one-off income only that may help reduce the commercial loans but is not a recurring income stream every year to continue repaying the loans. Council has very limited other options to increase its income such as reviewing fees and charges or finding other revenue sources, such as paid car parking at beaches. We are continuing to investigate other options.

You have a lot of staff. Have you looked at reducing staffing levels?

Yes, we reduced staff by about 25% in 2020-21 so that staff numbers are now less than pre-merger levels.

Can staff be more efficient to help keep delivering services at the same level?

Council has been ‘getting its house in order’ with implemented measures to manage costs by improving internal systems, processes and managing staff time better to ensure that cost-cutting measures have meant minimal service reductions for the community. Some of these productivity gains will continue to have an ongoing positive impact on improved service delivery and the community will see the benefits year on year. Council also has a Corporate Plan to improve our services across many areas of the organisation.

What is the annual operational budget for Central Coast Council?

Central Coast Council 2021-22 operational budget is $634.5million.

Is Council allocating money to build new things?

We have capped our capital expenditure to $175 million, and whilst we will deliver works to renew, maintain and upgrade existing assets, we will not be undertaking construction of new facilities and assets in the near future unless the funding is already in place (e.g., through external funding, collected levies, or restricted funds).

The new Gosford Regional Library – which is due to commence construction in the second half of 2022 - is an example of a new asset being delivered as it has funding secured through special levies, development contributions, asset sale proceeds, and an Australian Government grant.

Can’t you get more funding from other levels of Government to help pay for things?

The NSW and Australian Governments provide funding to help build essential infrastructure. Sometimes this is partial funding which means Council must find the rest of the funds to initially deliver, then maintain the infrastructure every year and replace the asset in future years.

How is this different to water, sewerage and stormwater drainage prices?

IPART also regulates the maximum prices that Council can charge for water, sewerage and stormwater drainage services and there is a separate process to set these charges. IPART has its own community consultation about Council’s pricing proposal that was submitted to IPART in September 2021 which closed on 14 April 2022. IPART issued draft prices and determination on 14 April 2022 and will release the final determination in May 2022 which will apply from 1 July 2022 to 30 June 2026.

It is important to remember that every dollar that we receive from your water, sewerage and stormwater drainage charges can only be spent on water, sewerage and stormwater drainage services such as water mains renewals, the upgrade of water and sewer treatment plants and stormwater management to ensure the ongoing health of our waterways.

What if I don’t pay my rates or can’t pay my rates? What will Council do?

Council understands that a rate rise will impact sections of the community harder than others. Council provides pensioner rebates and hardship assistance for those having trouble paying their rates and encourage the community to refer to Council's Debt Recovery and Hardship Policy which includes pensioner rebates as well as personalised payment plans. Council will engage with its customers in arrears to obtain payment to satisfy their account and prevent avoidable escalation of the debt recovery processes and the use of legal action. This Policy was reviewed March 2021 and available to view online on Councill’s policy webpage.

Timeline View

Initial investigation and research

Phase 1 community consultation

- Community awareness through direct mail and online information commences

Phase 2 – Engagement on service levels and options

- Face to Face Community groups 1:1 Meetings with Administrator

- Telephone Survey (randomly selected ratepayers)

- Online Survey (opt in)

- Community feedback on services and options – Community Reference Group

Phase 3 - Public exhibition of Long Term Financial Plan and Delivery Program (two options)

- Consultation on the Delivery Program and Long Term Financial Plan

Community feedback on two options reviewed

Council decides whether to make a submission to IPART

Application to IPART submitted

IPART application on public exhibition

IPART application under review

IPART produces final report

IPART announces determination results (we are here)